|

Our advisory team assists many people and companies in financial distress. Our unique expertise allows us to provide solutions across a wide range of financial distress issues that companies and individuals experience.

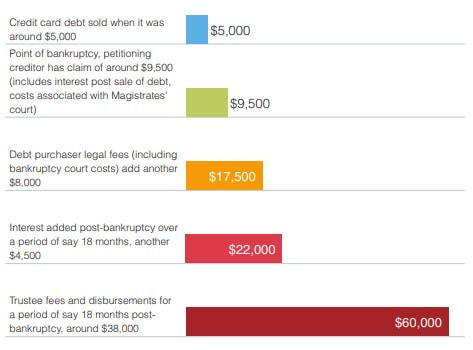

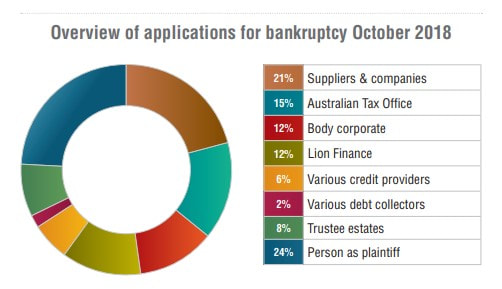

We negotiate daily with debt collection agencies and importantly understand both debtor and creditor's rights and obligations. Debt collection agencies should be flexible in their approach. A flexible approach involves making meaningful and sustainable payment arrangements that reasonably consider a debtor's ongoing living expenses. The ACCC and ASIC have produced a debt collection guideline for debtors and creditors, which encourages flexibility on the part of both parties. The guide includes recognising debtors who are vulnerable and experiencing financial hardship and appreciating that debtors may have several debts owing to different parties. If you have to deal with a debt collection agency on your own, be sure to reference this guide. Another helpful resource to access if you are comfortable dealing with a debt collection agency on your own is visiting the AFCA Datacube. The AFCA Datacube shows you the number of complaints against a debt collection company over the last twelve months. If you have any questions or need assistance, our team offer a cost-free consultation and can be contacted on 02 8304 9300. At the SR Group, we understand the experience of being forced into bankruptcy is highly stressful for people. It involves court proceedings, substantial costs, the need for legal advice and very often the fear of losing the family home. A person can be bankrupted on a debt as little as $5,000. This amount can balloon to many thousands after legal costs and fees are added. The following example is from the casework of Consumer Action Law Centre and involved a client who had an initial credit card debt of around $5,000. The amount outstanding 18 months after the forced bankruptcy was around $60,000. This how the debt can accumulate: Source: Consumer Action Law Centre July 2019 Article: ‘Who is making Australians bankrupt?’ This can mean that a small credit card debt could lead to the loss of the family home. Many people being made bankrupt are in financial hardship and could make a repayment arrangement to pay their debts if given the opportunity. Forced bankruptcy should be a last resort. SR Group seeks to avoid this burden for our clients. Constructively working with people in financial hardship gives them an opportunity to repay their debts. Extra time can mean the person is able to improve their financial position, for example, to recover from an illness or get back to work. In October 2018 alone, there were 265 filings for bankruptcy in total. The biggest percentage of filings involved individuals and various companies suing over debts. The next largest percentage of filings is the Australian Taxation Office (15%), followed by publicly listed debt collector, Lion Finance (12%), and then various corporate bodies (strata plans/owners corporations) (12%). Source: Consumer Action Law Centre July 2019 Article: ‘Who is making Australians bankrupt?’ SR Group achieves success with creditors through lump-sum settlements, mediation and negotiation. Credit Negotiation Case StudyBACKGROUND We provided advisory services to the director of a company that provided financial solutions to businesses who sold small ticket items. Our client’s company had operated successfully for several years before a combination of environmental and market conditions caused a significant downturn in revenue. After numerous attempts to revitalise the business and diversify, and in keeping with his directorship duties, our client made the decision to wind up his company and appoint a liquidator. After appointing the liquidator, our client found employment in a managerial role in a different company. While, the salary of the new role covered his living expenses, it did not leave enough money for him to meet his monthly creditor repayments, which were in substantial arrears. However, our client did not want to abrogate his personal creditor responsibilities and take the personal insolvency route. ACTIONS TAKEN TO ASSIST & OUR RESULT We acted on behalf of our client in aiming to settle each of his eight debt collectors (St. George, ANZ, Visa, NAB, Westpac, Prospa, Baycorp, Citibank) for the lowest possible amount on the grounds of financial hardship. A family member of our client generously offered a small pool of funds to help settle his creditors. Overall, we were able to reduce our client’s debt from $261,000 to $84,000, a reduction of 68%. Our client now only had to pay 32 cents in the dollar, which he had to do immediately upon receipt of each offer in the form of a discount lump-sum settlement. ATOThe most prolific user of the bankruptcy system is the Australian Taxation Office (ATO), which applied to make 543 people bankrupt in the past financial year of 2018-19. This number, however, was significantly lower than in the past three financial years. In the 2015-16 financial year the ATO applied to the Federal Court to make 1,215 people bankrupt. This fell to 1,061 people in 2016-17. In 2017-18 that number had fallen further to 833. SR Group helps assist clients with ATO issues through seeking:

The Commissioner of Taxation can release a person from a tax debt if making the payment would cause serious hardship. Serious hardship is defined as where the payment of a tax liability would result in a person being left without the means to afford basics such as food, clothing, medical supplies, accommodation or education. If the serious hardship standard is met (as determined by the ATO), then the person may be able to be released from all or part of the tax debt. Through our experience it must be noted that serious financial hardship can be a difficult standard to meet. SR Group has a proven track record in negotiating with the ATO to reach a mutually agreeable resolve. ATO Case StudyBACKGROUND

An established travel agency established in 1998 incurred financial distress, due to ongoing family health issues over a 10-month period. This difficult period resulted in neglect of the business, which ultimately led to a winding up application from the Australian Taxation Office (ATO). ACTIONS TAKEN TO ASSIST & OUR RESULT On behalf of our client, we negotiated with the ATO through various correspondences and reached a settlement equivalent to 48% of the initial debt. We achieved a full remission of interest and penalties on the debt, as well as establishing a monthly payment plan over two years to settle the debt, allowing the client to effectively manage their cash flow as the business got back on its feet. DIRECTOR'S TESTIMONIAL “I recently used the services of the SR Group and cannot recommend them highly enough. In particular I dealt with the Client Relations Manager Mandana Missaghi, her professionalism, diligence and empathy helped me through a particularly difficult situation. Mandana has a very understanding and positive attitude which I really appreciated through all our dealings. The SR Group thoroughly investigated my situation, guided me through the available options & then negotiated on my behalf to reach an agreeable solution. I cannot thank the SR Group enough for their assistance & advice.” EXCLUSIVE

This couple has lost their successful small business after its tax payments were taken by an accountant the ATO was warned about three years ago. Police are expected to charge Coffs Harbour’s Stephen Raymond Douglass as soon as this week over his pilfering of at least $500,000 and possibly $1 million from Warren and Sheenah Whitten’s Woolgoolga-based steel fabrication company, Arc Attack Engineering — money they thought he had remitted to the ATO. In a confession he emailed to the Whittens a month ago, Douglass attempted to elicit sympathy by blaming his actions on a gambling addiction. However, there was no mention of a gambling addiction in 2014 when another Woolgoolga client, Eadie Cabinet Making, discovered a decade’s worth of GST had not been paid to the tax office. John Rolfe The Daily Telegraph |

NEWSROOMIn our Newsroom, we share advice, the latest news, financial tips and our case studies. Please enter your email address to receive our monthly news update. Archives

February 2022

Categories

All

|