|

For many victims of financial disputes, it can be a daunting process to navigate recovering your funds. You may have tried to resolve the issue with the financial provider and have had no response or success.

Where do you go next? The Australian Financial Complaints Authority (AFCA) is a non-government dispute resolution organisation providing free, fair and independent help with disputes between consumers and financial providers. It is compulsory for all Australian Financial Services Licence and Australian Credit Licence providers to be members of AFCA. To have a complaint considered by AFCA it has to be within six years after you first became aware of the loss. With an exception of the current one-year window to consider complaints dating back to 1 January 2008. AFCA is only allowed to accept legacy complaints until 30 June 2020. On Monday 4 February 2019, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry release its final report containing 76 Recommendations. At 4:20pm, Treasurer Josh Frydenberg held a press conference announcing that the Government had agreed to adopt 75 of the 76 recommendations made by the royal commission, opting against fully implementing a suggested crackdown on mortgage brokers.

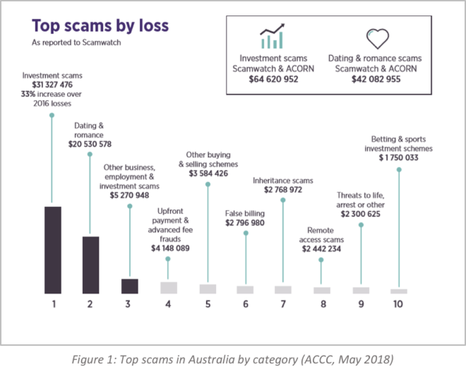

The most important recommendation for our clients is 7.1 – compensation scheme of last resort. The Government has agreed to this recommendation by stating: “For the first time the Government will establish a compensation scheme of last resort to ensure that consumers can have their case heard and be confident that where compensation is owed it will be paid. This will be a scheme paid for by industry reflecting their obligation to right their wrongs.” In 2017, Australian’s lost A$31.3 million to investment fraud schemes, per the May 2018 report by the Australian Competition and Consumer Commission (ACCC). This figure is almost certainly an under-representation on the total amount lost, as investment fraud is one of Australia’s least reported crimes, mostly due to shame or embarrassment of the victims. But don’t be embarrassed, investment frauds are becoming more sophisticated and harder to recognise, and with over 200,000 reports of scams last year, you are certainly not alone.

The royal commission will spend the next two weeks hearing evidence about misconduct and conduct falling below community expectations within Australia’s superannuation sector. We are representing many people that have been mislead and their nest egg was not what they expected for retirement. Reform is needed especially with our ageing population.

SR Group is standing firmly with Professor Ramsay's review for the federal government recommending the establishment of a compensation scheme of last resort for victims of poor financial advice. With the Royal commission dedicating public hearings to financial advice and Dover showcased it is an area needing the most immediate attention of last resort compensation. Time for reform.

In a letter to Malcolm Turnbull last week Bill Shorten has suggested an extension of the inquiry, an apology and compensation scheme were the “least the government can do” in the future. SR Group sees this as a step forward in advocating for reform in the financial sector.

Our Managing Director Susie Bennell was instrumental in bringing this to the government’s attention. Life changing news for people that have been wronged by banks and other financial institutions.

EXCLUSIVE

This couple has lost their successful small business after its tax payments were taken by an accountant the ATO was warned about three years ago. Police are expected to charge Coffs Harbour’s Stephen Raymond Douglass as soon as this week over his pilfering of at least $500,000 and possibly $1 million from Warren and Sheenah Whitten’s Woolgoolga-based steel fabrication company, Arc Attack Engineering — money they thought he had remitted to the ATO. In a confession he emailed to the Whittens a month ago, Douglass attempted to elicit sympathy by blaming his actions on a gambling addiction. However, there was no mention of a gambling addiction in 2014 when another Woolgoolga client, Eadie Cabinet Making, discovered a decade’s worth of GST had not been paid to the tax office. John Rolfe The Daily Telegraph  A DODGY investment destroyed this couple’s marriage. Now, with funding from the federal government, Peter Dimitrov is taking the financiers to the High Court — with his ex-wife’s support. Mr Dimitrov is battling Bendigo and Adelaide Bank, which is chasing him for about $550,000, half of which is interest. He borrowed the money on the advice of failed financial adviser Steve Navra, who recommended he buy into agribusiness projects run by Great Southern between 2006 and 2008. About 75,000 Australians invested $5 billion in agribusiness schemes, including $1.8 billion in Great Southern. |

NEWSROOMIn our Newsroom, we share advice, the latest news, financial tips and our case studies. Please enter your email address to receive our monthly news update. Archives

February 2022

Categories

All

|