|

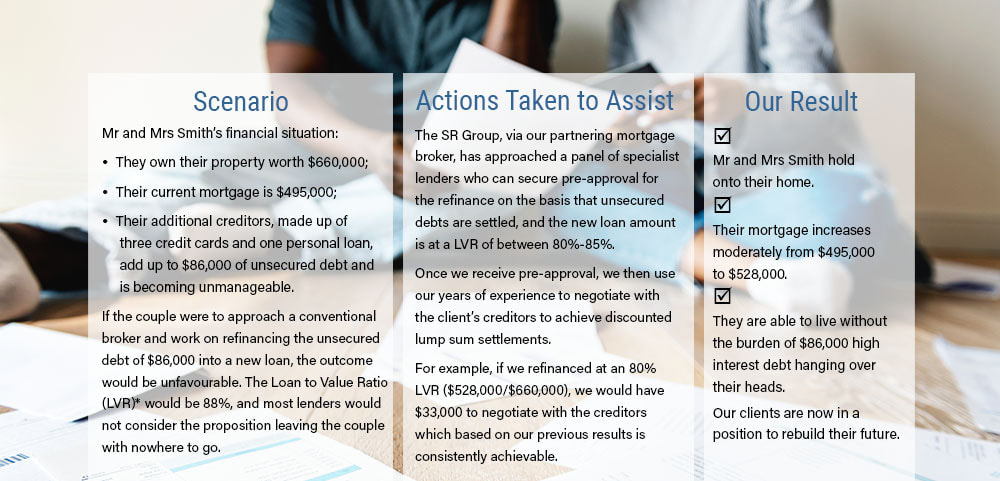

We understand the experience of being forced into bankruptcy is highly stressful for individuals. The process can involve court proceedings, substantial costs, the need for legal advice and very often - fear of losing the family home. With an individual able to be bankrupted on a debt as little as $10,000, the final overall amount can balloon quickly after legal costs and fees are added. At SRG Advisory, we provide services to individuals experiencing financial distress; tailoring advice and developing specific strategies to improve their financial outlook. Our aim is to minimise the financial distress of the client to enable them to get back on track without the need for bankruptcy. We understand the experience of being forced into bankruptcy is highly stressful for people. Personal Bankruptcy involves court proceedings, substantial costs, the need for legal advice and very often - the fear of losing the family home. A person can be bankrupted on a debt as little as $10,000. This amount can balloon to many thousands after legal costs and fees are added. This can mean that a small credit card debt could ultimately lead to the loss of the family home. Forced bankruptcy should be considered as a last resort and SR Group seeks to avoid this burden for our clients. We constructively work with people in financial hardship in order to provide them an opportunity to repay their debts. Through negotiating and mediating with creditors such as credit card providers, banks, and the Australian Taxation Office (ATO), we are able to restructure any financial exposure. For example, a recent client came to us with a debt of $273,000 across eight creditors. We acted on behalf of our client in aiming to settle each of his eight creditors (Citibank, ANZ, Prospa, Westpac, NAB, St. George, Macquarie, ATO) for the lowest possible amount on the grounds of financial hardship. A family member of our client generously offered a small pool of funds to help settle his creditors. Overall, we were able to reduce our client’s debt from $273,000 to $99,000, a reduction of 64%. Our client now only had to pay 36 cents in the dollar, which he had to do immediately upon receipt of each offer in the form of a discounted lump-sum settlement. In addition to restructuring or negotiating debt, we provide asset and income protection strategies as well as support in the implementation and management of insolvency strategies. If legal assistance is required, we work closely with a select group of trusted law firms to ensure clients receive the additional support they may require. Dynamic Debt Consolidation Dynamic Debt consolidation is a service the SR Group offers where we aim to negotiate a discounted lump sum settlement with our clients' creditors by refinancing their existing mortgage. The scenario below outlines how we often achieve this: If you are in personal debt, it is imperative to address the issues head-on and have a plan of action in place. Please give us a call on (02) 8304 9300 or email us at [email protected] for a cost-free and obligation-free consultation to see how we can help you.

Comments are closed.

|

NEWSROOMIn our Newsroom, we share advice, the latest news, financial tips and our case studies. Please enter your email address to receive our monthly news update. Archives

February 2022

Categories

All

|